My general trading style is to take short term trades on Large caps to the tune of 10-15% generally and look for major moves in midcaps.

In my previous views i have mentioned the possibility of Sensex dipping to 18.5k-19.6k levels roughly and not going below 17.8k after which there could be a possibility of a huge move over the next 6-12 months.

So as of now the large cap stocks in radar technically are –

ICICI Bank – ( earlier initiated a buy at 1040 )

On the weekly charts stock has given an interesting breakout at 1000-1040 levels which could be retested after this 10-15% jump move from 1040 to 1160.

An interesting investment if comes down to 1050 or lower.

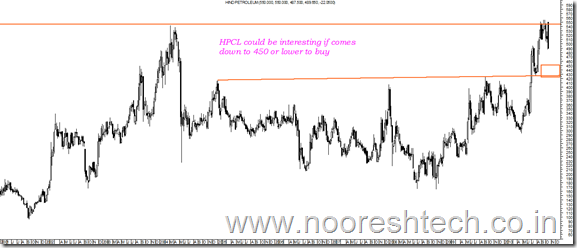

HPCL :

The stock has seen the current fall after testing life highs made in 2008.

A major breakout was seen at 450 levels. A retest of similar levels could be a nice risk-reward trade to enter.

BPCL :

Similar observations but only difference is after crossing 2008 highs the stock saw a huge move.

Retest will be interesting.

HINDUSTAN UNILEVER:

One of my favorite stocks – Earlier we took a nice trade from 240 to 265 and then 275 to 305.

Currently the stock has a huger resistance at 320 which is a high seen in 2000. Crossing a 10 year high would be extremely bullish signal to come which i expect over the next year and HUL becoming an aggressive bet.

Dips to 270-285 is an interesting defensive play which could give a surprise in next 12 months.

Also another stock in watch is Reliance Inds but we would need to see a cross of 1120. Will post the chart soon on it.

Hope i get time to look into the same stocks on dips but investors should bookmark this page and have a relook whenever the indices drop and remind me to cover this back 🙂

The above 4 and reliance inds could be my top 5 picks as of now but will review at dips to 19k.

For more detailed reports which will be published by Analyse India from November ( Plan to have a much better coverage and more detailed insights with a larger team)

Advisory Services – nooreshtech.co.in/services

Regards,

Nooresh

09819225396 ( after market hours only or message me if u need to talk to me )

October 18, 2010

hi nooresh,

I bought 5000 shares of JMFinance @Rs. 44 on friday seeing great volumes. Can u give me targets technically. Can it go to 60.

October 18, 2010

Hi vivek,

Speculative built up in the stock can do 55

October 18, 2010

Hello nooreshtech now that dcb is out wit the results wat do u look at it’s short to medium term target????

October 18, 2010

Hi Adit,

The outlook remains positive for long run. Dont expect much in short term unless there is some announcement

October 18, 2010

Hi Nooresh,

Break out expected tomorrow.

Regards,

G.SRINIVASAN

(your sincere follower)

October 18, 2010

Hi Nooresh,

Strong Breakout expected in PTC in the coming days.

Regards,

G.SRINIVASAN

(your sincere follower)

October 18, 2010

Hello Nooresh

I have Kinetic Motor – 3000, what is your opinion in short term .

Thanks Rohit

October 18, 2010

hello sir,

thanks for Lokesh Machines. what is your latest view about Ion exchange. can i accumulate arnd 200-210? please advise.

October 25, 2010

Hi Nooresh,

I have brought 1000 shares of Sterlite Ind at 183(Future Oct).

Please let me now if i can recover my loss.

Regards,

shekhar

October 25, 2010

Hi Shekhar,

You can hold on the stock can bounce back to 178-182.

Regards,

Nooresh